Account Holder Refunds

When a deposit-bearing account is closed, and the account has funds remaining in it, you need a way to return the funds to the account holder. At Galileo, you set up a refund product so that you can issue refund checks for the outstanding balance. This guide explains what the account holder refund product is and how to use an automated process to issue refund checks to an account holder once their account is closed. After the refund product has been configured, the check can be issued via the automated process outlined in this guide, or you can self-issue a check through the CST.

Note

To close a secured credit account, see Account closure status reporting in the Credit Reporting at Galileo guide. Credit account closures do not involve the refund product.

The account-holder refund process can be initiated by the account holder or by the program manager. This guide contains the parameters to set during product configuration to optimize the experience for program managers and their account holders.

Decisions to make

As you set up your refund process, you will need to make these decisions:

- Under which conditions you close a deposit-bearing account with a refund as opposed to without refund. See Account closure types for details.

- Which methods to offer to the account holder to retrieve the balance of the account before it is closed. These options must be included in the Terms and Conditions for the account:

- Spend remaining funds

- ATM withdrawal

- ACH transfer

- Whether the card (if any) must be mailed back before a refund check can be issued.

- The maximum amount for a refund check.

- If you permit or require customers to deposit funds before passing KYC/CIP, determine the maximum amount of a refund check when the customer fails KYC/CIP.

- The number of days after an account has been canceled ("waiting period") to issue a refund check. Galileo recommends choosing an interval based on your standard authorization expiration times and any potential payment-hold activity the client may initiate such as an ACH transfer. This waiting period gives the account holder time to retrieve the remaining funds using methods other than a refund check, if they prefer.

Refund product process

The refund product process has five basic steps:

- You or the account holder decide to close an open, deposit-bearing account that contains a positive balance.

- If you are initiating the account closure as part of a program shutdown, or if you are moving the accounts elsewhere, you should follow procedures that are specific to that use case instead of following this procedure. Galileo can help you devise those procedures.

- You present options to the account holder to retrieve the balance. See Recommended sequence to refund closed accounts.

- When the account holder has withdrawn the funds, you should provide a way for the account holder to notify you that they've withdrawn the funds, such as a control on your interface or a customer service phone number.

- You close the account using the Program API or the CST. If there are still funds in the account, the waiting period begins.

- After the waiting period expires, any remaining balance is automatically transferred to a Galileo-hosted refund account.

- Galileo issues and mails a paper check for the refund amount to the former account holder. The refund check includes:

- The program name

- The name of the account holder

- The full refund amount

- Instructions for the account holder to cash the check within 180 days

- Envelope with a Galileo return address

Account closure and balance IDs

When closing deposit-bearing accounts, checks are issued per balance ID (Galileo account ID). For example, if one cardholder has a DDA plus a savings account, and each account has a different balance ID, then when both accounts are closed with refund, two refund checks are issued.

On the other hand, if there are two accounts that share a balance ID, then when closing those two accounts with refund, one check is issued to the primary account holder.

Recommended sequence to refund closed accounts

Before a deposit-bearing account is closed, Galileo recommends that you present the following options to the account holder, in this order, according to the options that you have outlined in the Terms and Conditions for this account:

- Allow/encourage the account holder to spend the remaining funds.

- Allow the account holder to withdraw the funds via ATM. Keep in mind that the machine will only provide whole dollars, not cents, and the bill denominations may be $20 or $10 bills, which could cause the account holder to incur a loss.

- Initiate an ACH transfer of the remaining funds to the account holder’s designated financial institution. The account holder might need to create an ACH account for this transfer.

- See Creating an ACH transaction in ACH Endpoints for instructions.

- Use the refund product to send the account holder a paper check via the refund process, if the funds are not otherwise withdrawn.

Account closure types

These are the account-closure options that you have. Use the Modify Status endpoint or go to the Account Info > Account Info screen in the CST.

Canceled with refund

Account status: C

- Modify Status —

type: 13 - CST — Cancel w/ Refund

If the account holder initiates the closure of a deposit-bearing account with a positive balance, follow the steps in Refund product process to help the account holder retrieve the remaining funds before closing the account.

- This type changes both the account and associated cards to

status: C. - The type does not close related savings accounts. If you need to close other accounts that the account holder owns, you must close them separately.

- Do not use Modify Status

type: 2to change the account tostatus: C, because it will not launch the account-refund process.

Canceled without refund

Account status: Z

- Modify Status —

type: 20(all accounts and cards, including secondaries)type: 16(specified PRN and cards)

- CST — Cancel w/o Refund

You can close a deposit-bearing account without a refund as the result of a zero balance on the account, fraudulent activity on the card, or government seizure of the individual account holder’s assets. None of these scenarios require the use of Galileo’s refund product, because no refund will be issued back to the account holder.

- This type changes both the account and associated cards to

status: Z. - All other accounts and cards associated with the same customer record, including secondaries, are changed to

status: Z. - Any remaining funds remain in the closed account indefinitely until you manually move them. Create procedures in cooperation with your bank for handling these funds according to the reason the account was closed.

Important

Mastercard and Visa consider

status: L(lost),status: S(stolen),status: C(canceled), andstatus: Z(canceled without refund) to be permanent statuses. As of April 21, 2025, issuers are required to returnresponse_code: 46for accounts or cards with aCorZstatus. For response codes representing theLandSstatuses, refer to Authorization Response Codes. If you reactivate a card or account that was closed, the card network could assess penalties for transactions attempted against that card. To temporarily close an account or card to reopen later, usestatus: D(disabled).

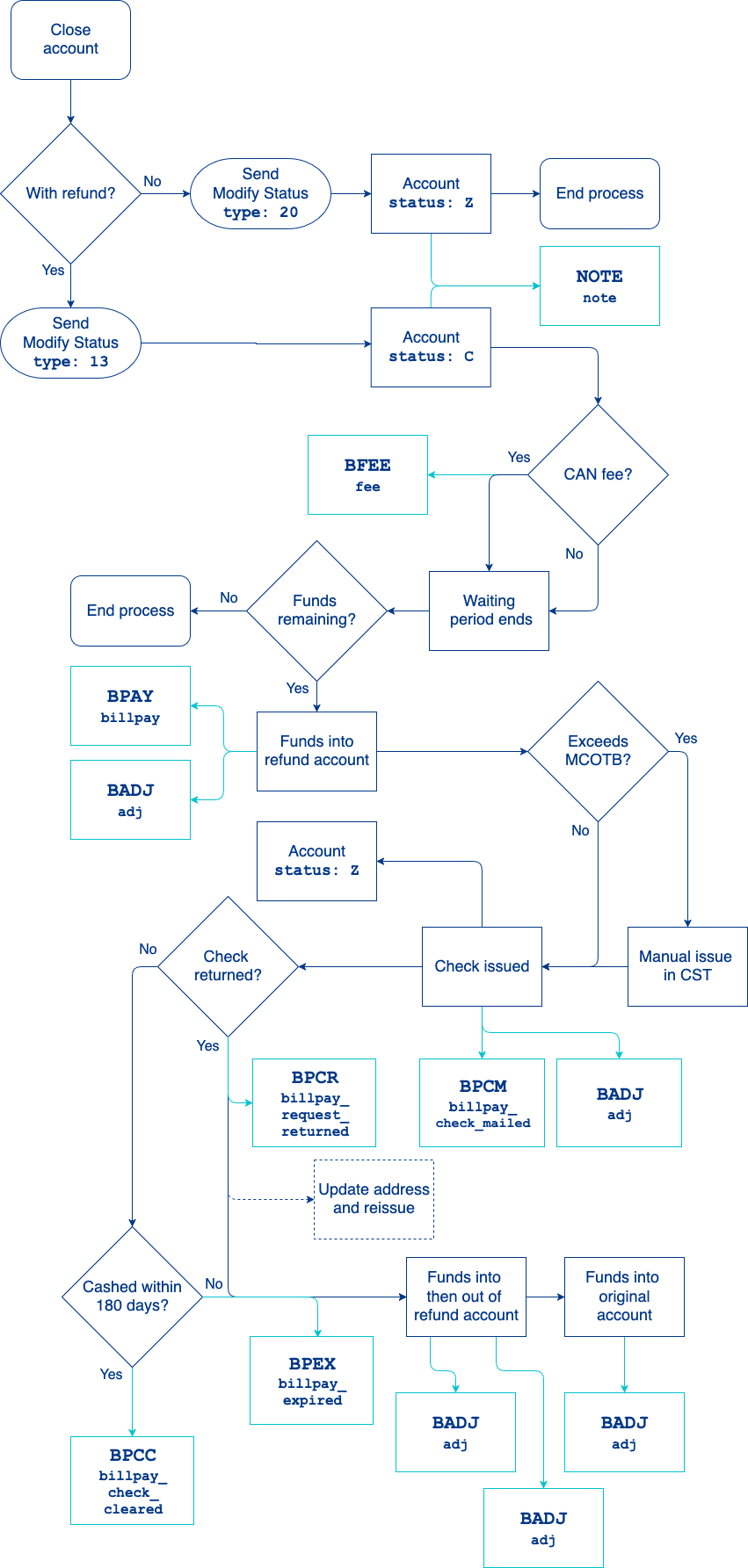

Account holder refund workflow

This is the sequence of events when closing an account using the Program API.

- You or the account holder decide to close a deposit-bearing account with a positive balance. The account holder has already been given options to move the funds elsewhere, but there are still funds remaining.

- Close the account using one of the methods in Account closure types.

- Galileo sends the

NOTE: noteevent message with the text you provide in thetextfield, indicating that the account was closed.- If the CAN fee (account closure) is configured, Galileo assesses that fee and sends the

BFEE: feeevent message. See Pending fees in the case that there are insufficient funds for the fee.

- If the CAN fee (account closure) is configured, Galileo assesses that fee and sends the

- For an account canceled with a refund, the waiting period starts. The configurable waiting period is set by the MDAYC parameter.

- If the account is canceled without a refund, the remaining funds remain in the closed account until manually moved out.

- At the end of the waiting period, if there are still funds in the account, Galileo automatically moves the funds out of the closed account and into a Galileo-hosted refund account.

- Galileo sends the

BPAY: billpayevent for the refund account withotype: Zand sends theBADJ: adjevent message for the closed account withotype: v(canceled account refund adjustment).

- Galileo sends the

- Galileo determines whether to issue a refund check by comparing the refund amount with the MCOTB parameter.

- If the amount exceeds the limit in MCOTB, a check is not automatically issued, and the funds remain in the refund account. You can use the CST to manually issue the check.

- If the amount does not exceed the limit, Galileo mails a paper check for the amount and changes the account to

status: Z. Galileo sends theBPCM: billpay_check_mailedand theBADJ: adjevent messages, both for the refund account.

- The account holder should receive the check after about 10 days from the time the check is issued.

- If the check is returned in the mail, the Galileo mail room marks the check as void in the system, and Galileo sends the

BPCR: billpay_request_returnedevent message.- Galileo moves the check funds into the refund account, and sends the

BADJ: adjevent message withotype: Z. - Galileo immediately moves the funds from the refund account and back into the original closed account. Galileo sends the

BADJ: adjevent for both accounts withotype: v(canceled account refund). - If you have an updated address for the account holder, you can update the address in the CST or via batch file and then manually reissue the check.

- Alternatively, you can use the Update Account endpoint to update the address, but only if the UPDCZ parameter is set at the provider level. This parameter permits you to update account information with that endpoint for accounts that are in statuses

CandZ.

- Alternatively, you can use the Update Account endpoint to update the address, but only if the UPDCZ parameter is set at the provider level. This parameter permits you to update account information with that endpoint for accounts that are in statuses

- Galileo moves the check funds into the refund account, and sends the

- If the check is returned in the mail, the Galileo mail room marks the check as void in the system, and Galileo sends the

- The account holder must cash the check within 180 days (six months) of the check's issue date.

- If the check is cashed, Galileo sends the

BPCC: billpay_check_clearedevent message. - If the check is not cashed, the check is voided and the funds are automatically returned first to the refund account and then to the account-holder account. Galileo sends the

BPEX: billpay_expiredevent message when the check expires, and as the funds are moved, Galileo sendsBADJ: adjevent messages withotype: vfor the account-holder account and the refund account.

- If the check is cashed, Galileo sends the

Important

When the check amount is moved back into the closed customer account, it constitutes a transaction on the account, and the last transaction date is thereby changed. This changed date affects the escheatment process.

Reissuing refund checks

Before you can reissue a check, the original check must be manually canceled. Automated processes should have moved funds from the refund account back to the closed customer account. Follow these instructions in the CST to reissue a check.

1. Cancel the original check

- Open the product refund account by selecting the program and selecting Name (First / Last) as the search criteria. Input the term "refund" in the last-name field and search.

- Navigate to Account Info > Bill Payments.

- On this page, locate the refund check that needs to be canceled. (If it is already canceled, skip this step.)

- Next to the check, click Cancel Check.

- The check status will update to Check Cancellation Requested.

- Wait for the check funds to return to the refund account before continuing. This process typically occurs overnight but can take up to 48 hours (exceptions include weekends and holidays).

- When the funds have been returned, the check status updates to Check Canceled

- An automated process moves the funds from the refund account to the closed customer account.

2. Reissue the refund check

- Go to the individual account-holder account and navigate to Account Info > Account Info.

- On this page, select the option to manually issue a refund check.

- Follow the prompts to issue the check.

Events API

You can arrange with Galileo to receive some or all of these events related to refund checks. Some of the events have billpay_ in the name because refund checks enter the same workflow as billpay checks.

Set up all of these events on the refund product. For deposit-bearing products (DDA, savings), verify that BADJ: adj is set up, and then determine which billpay-related events you would like to receive for that product. For every billpay-related event that you enable for the deposit-bearing account, include the msg_id in the MSGDA product parameter.

For the events that are set up for the refund account, the pmt_ref_no and balance_id fields will refer to the refund account, not to the closed account. For some of these events, you have the option to add two fields that link the event back to the original closed account:

original_balance_idoriginal_prn

| Event | Description |

|---|---|

NOTE: note | A note was added to the customer account. The closure is noted in the text field. |

BADJ: adj | An adjustment was posted to the customer account or the refund account, with funds moving in or moving out. |

BFEE: fee | A fee was assessed to the customer account. |

BPAY: billpay | The refund check amount has been adjusted out of the refund account. |

BPCM: billpay_check_mailed | A refund check order was included in the check file. |

BPCC: billpay_check_cleared | A refund check was cashed, and the payment has cleared. |

BPEX: billpay_expired | A refund check did not clear 180 days after the check's date, and the check has been voided. |

BPCL: billpay_cancelled | A refund check was cancelled in the CST. |

BPCR: billpay_request_returned | The refund check was returned to Galileo. |

Tip

When a refund check is issued to the account holder, Galileo changes the account status from

CtoZto prevent the system from issuing duplicate checks. Becausestatus: Zis also the status for accounts that were closed without refund, you might find it difficult to distinguish between accounts instatus: Zthat were closed with refund and those that were not.To help make this distinction, make sure that

BPCM: billpay_check_mailedorBPAY: billpayis set up on the refund account and request thatoriginal_balance_idandoriginal_prnbe added to the payload. When you receive the event with the refund account number inpmt_ref_no, capture theoriginal_prnandoriginal_balance_idto identify accounts that were closed with refund.

Galileo setup

These parameters control how Galileo processes refunds for your account holders. All parameters are set at the product level.

Refer to the Account holder refunds table on the Parameters page for additional details on these parameters.

| Parameter | Description | Deposit-bearing account | Refund account |

|---|---|---|---|

| OGRAC | Required to set up a refund account for the product. Specifies the refund account to debit when paying out a refund for this product. When this parameter is set, RANAM is required on the refund account. | XID | — |

| RANAM | Required on all refund products. When this parameter is not populated, refunds are not processed from this product. | — | Refund account name |

| CRCHK | Required when OGRAC is set. Controls whether a card must be mailed back before a refund check is issued. When this parameter is not set, accounts will not be refunded. When this parameter is set to Y, MCTOB and MDAYC are required. | Y or N | — |

| MCOTB | Required when OGRAC and CRCHK are set. Contains the maximum amount for a refund check when a deposit-bearing account is canceled. When this parameter is not set, attempts to issue a refund are denied. | Float | — |

| MDAYC | Required when OGRAC and CRCHK are set. Specifies the number of calendar days after a deposit-bearing account has been canceled to issue a refund. When this parameter is not set, attempts to issue a refund are denied. | Integer | — |

| MDAYP | Required when OGRAC is set. Specifies the number of days after the last payment to issue a refund on an account that fails KYC/CIP. When this parameter is set, MTOTB is required. | Integer | — |

| MTOTB | Required when OGRAC and MAYDAP are set. Contains the maximum amount for a refund check that is issued when an account fails Galileo’s integrated KYC/CIP process. | Float | — |

| MSGDA | Optional. Contains the msg_ids of events that are triggered regardless of account status. Add the msg_id of events that you want to receive even when the account is not in status: N (normal, active). Every event that you specify in this parameter should be enabled on the deposit-bearing account. Suggested msg_ids: BADJ, BLVF, BPAY, BPCC, BPCM, BPCQ, BPCR, BPEX | comma-separated msg_ids | — |

| RETRY | Optional. Specifies the number of times to retry sending an event message before putting the message into error status. Default: 0 | any | any |

| RTRDL | Optional. Delay in seconds before resending a message. The delay increases exponentially for each retry by multiplying the square of the retry count by RTRDL. Default: 60 | any | any |

Updated 3 months ago