Corporate Credit

Companies that issue charge cards to their employees for business-related expenses can find that keeping track of all those account balances is complicated. Generally, each card has its own credit limit, and then to see how much of each credit limit is available, the balances from dozens, hundreds, or even thousands of accounts must be totaled. This laborious process often provides a mere snapshot that quickly goes out of date, and so the totaling must be repeated.

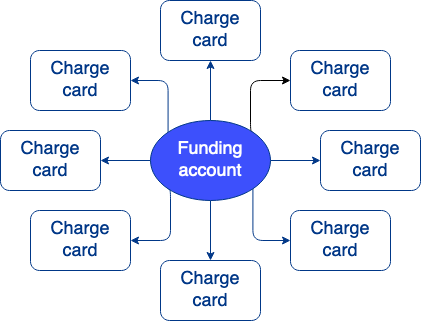

Galileo's Corporate Credit solution can help remove this accounting complexity by providing one central account that has a single credit limit set. When a connected card is used to make a purchase, Galileo checks the credit limit of the central account, and if enough credit is available, approves the purchase. All of the connected cards draw from the same credit limit, and when the credit limit is reached, all purchases are denied until the balance is paid down.

With this arrangement, a company only has to check the credit limit of the central account to see how much remains, while at the same time has access to the transaction records for each individual card.

For individual cardholders, the purchasing experience is the same as with a conventional charge card. With Galileo's Corporate Credit solution, cards are declined for insufficient funds when the credit limit on the funding account is exceeded. Other reasons for declining a transaction, such as fraud rules, velocity limits and merchant type, can apply to individual cards or to the program as a whole.

For a similar solution for debit cards, see the Real-Time Funding guide.

Use case 1

A corporation issues three types of cards to its employees, depending on the employee's role and responsibilities. Each department has its own central account, and the account receives a credit limit according to its needs. For example, the Sales department has a $100,000 credit limit per month in its central account, and all of the Sales employees have cards that are tied to that central account. Some employees have a card with a weekly limit of $200 at office supply stores, others have a card with a $500 weekly limit that can be used at a wider number of stores, and the executives have cards with no limits.

Every time one of the cards is used to make a purchase, the card draws on the credit limit of the central account. The department regularly checks the credit limit of the central account to ensure that they're staying within budget, and at any time they can get an itemized list of what each card spent and where.

Use case 2

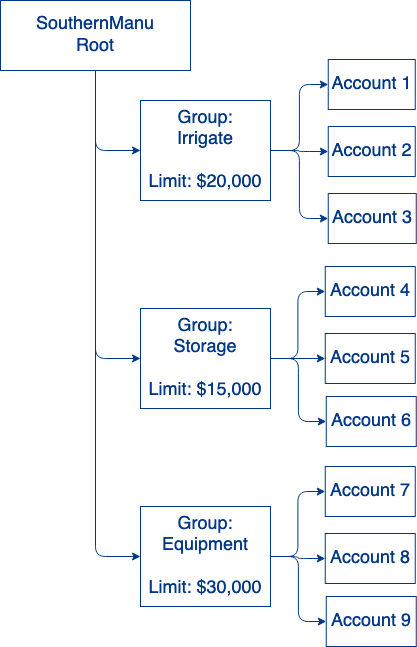

Southern Manufacturing makes products to support the farming industry. Production is divided into three main divisions: irrigation systems, storage, and heavy equipment such as tractors, harvesters and cultivators.

For this company you set up a corporate hierarchy with each division in its own group, and each group has a funding account with a different credit limit.

With the accounts organized by group, you can create reports for each division and present them in a customer dashboard. The dashboard could show the remaining credit limit per division and permit the customer to drill down to expenditures per card. The company could also use your dashboard to make payments into each funding account.

If you enable Account-Level Authorization Controls for Southern Manufacturing, you can set different spending limits for each account, according to the cardholders' levels of responsibility. For example, the managers in each group could be authorized to spend more per week than the regular cardholders, or the cardholders in one division could be authorized to make purchases at merchant types that cardholders in other divisions cannot make.

How it works

The Corporate Credit solution is one of Galileo's real-time funding (RTF) solutions, which link multiple spending cards to a central funding account. Corporate Credit uses credit BINs whereas Real-Time Funding uses debit BINs.

You set up a Corporate Credit (CC) funding account, give it a credit limit, and then create CC spending accounts that are connected to the CC funding account. The CC spending accounts all draw on the credit limit of the CC funding account, and the spending accounts have a 0.00 balance at all times. For this example, the credit limit on the funding account is 1000.00.

When a cardholder uses a CC card to make a $50 purchase, the sequence of events is as follows:

- The merchant sends an authorization request to Galileo for –50.00.

- Galileo checks the available credit of the CC funding account. There is sufficient credit.

- Galileo moves 50.00 from the CC funding account into the CC spending account and then approves the transaction. This movement of "funds" is for accounting purposes only, because there are no actual funds in the CC funding account. The CC funding account now has a balance of –50.00 with 950.00 in available credit. The CC spending account has a 0.00 balance.

- A few days later, when the –50.00 settlement arrives, Galileo "reverses" the 50.00 in the spending account, and for a moment the spending account has a 50.00 balance. Then Galileo posts –50.00 to the spending account, which returns the balance to 0.00. The available credit in the funding account is still 950.00 and the balance is still –50.00.

- At the end of the billing cycle, the entire balance on the CC funding account is due. When the 50.00 balance is paid, the available credit on the CC funding account returns to 1000.00 and the balance is 0.00.

- Whenever part of the balance is paid, the available credit on the CC funding account increases by the amount of the payment. For example, if 30.00 is paid, the available credit becomes 980.00 and the balance is –20.00

- If the spending account receives a merchant credit or reversal, the amount is moved into the funding account, and the available credit is increased by that amount.

Adding funds to the funding account

Although it is not necessary for the CC funding account to contain actual funds, it is still possible to add funds to the account, which then increases the amount of available credit. For example, if the credit limit for the funding account is 1000, you can move 500 into the account. When you call Get Corporate Credit Summary, it returns these values:

available_credit: 1500credit_limit: 1000

The cards that are connected to this funding account can therefore spend 1500 before reaching the credit limit.

Note

See Corporate Credit Transaction Examples for example ledger entries.

Corporate Credit account characteristics

Galileo has created two new product categories: Corporate Credit Funding Account and Corporate Credit Spending Account.

Corporate Credit funding product

A CC funding product (product type 32) has these characteristics:

- Supports:

- Thousands of connections with CC spending accounts

- ACH credits and debits, both incoming and outgoing

- Connections to CC spending accounts with different product IDs

- Does not support:

- Card transactions

- Galileo KYC/CIP process

- Balance sharing

- Velocity, MCC, or merchant ID authorization controls at the product or account level

- Cannot be a secondary account or have secondary accounts.

- Follows these rules for product-switching:

- An account can be product-switched, but only to another CC funding product.

- Cannot switch from a CC funding product to a non-CC funding product or vice-versa.

Corporate Credit spending product

A CC spending product (product type 33) has these characteristics:

- Is a credit-type product.

- Can be a physical card, virtual card, or Digital First card

- Can be associated with only one CC funding account.

- Cannot be moved to another CC funding account.

- Does not share a balance with the CC funding account or other CC spending accounts.

- Supports:

- Conventional card transactions, except ATM program fees and balance inquiries

- Cashback, at the program manager's discretion

- Velocity, MCC, and merchant ID authorization controls at the product and account levels

- The Galileo KYC/CIP process. Whether you need to run KYC/CIP to create a spending account depends on your bank's requirements.

- Merchant credits

- Secondary accounts such as savings

- Does not support

- Bill pay

- Real-time ACH transactions

- Card loads

- Follows these rules for product-switching:

- An account can be product-switched, but only to another CC spending product.

- Cannot switch from a CC spending product to a non-CC spending product or vice-versa.

You can create different CC spending products according to the card types that you want to provide to cardholders. For example, you can create a CC spending product with a virtual card and another product with a physical card, or you can create card products with different spending limits, and all of these card accounts can be associated with the same CC funding account.

Note

The linkage between CC funding accounts and CC spending accounts is created at the account level, during spending-account creation. There is no back-end setting to link a CC funding product to CC spending products.

Creating CC accounts

See Creating Corporate Credit Accounts for instructions.

Managing CC accounts

See Managing Corporate Credit in Creating Corporate Credit Accounts for instructions.

Migrating existing accounts to CC accounts

Ask Galileo for advice on how to proceed. Do not attempt to use product switching to convert non-CC accounts into CC accounts.

Updated almost 2 years ago