Direct Deposit Switch

Direct deposit functionality is a powerful factor in increasing customer engagement and spend. Accounts with direct deposit have ~10x lifetime value over accounts without direct deposit. However, the conventional method of setting up direct deposit is cumbersome and mistake-prone. The account holder has to manually provide routing and account numbers to their employer or payroll provider, either by filling out a paper form, providing a voided check, or by updating information in an online portal. There are no validation checks to ensure that there were no typos—only when the first paycheck arrives several days or weeks later does anyone know whether the setup has been successful. If something went wrong, it can take quite a while to fix the problem.

Galileo's Direct Deposit Switch provides your customers with a speedy, guided method to set up direct deposit that avoids many of the pitfalls involved with the manual process.

- Galileo's Direct Deposit Switch provides a ~50% increase in direct deposit adoption over conventional methods.

- The convenience and ease of Direct Deposit Switch provides satisfaction to customers, who expect a seamless experience from today's banks.

- Advances across the market in direct deposit setup mean that your offering will be competitive.

- About 70% of your customers can use Direct Deposit Switch because Galileo is integrated with:

- Most top employers and payroll companies

- All federal agencies

- All state unemployment agencies

- Gig-worker platforms

- Additional coverage as partner integrations grow

- Instead of integrating with multiple vendors, consolidate your direct deposit functionality with Galileo's one-stop shop.

- Galileo's strong market presence and higher volume tractions mean better rates than you could get from integrating directly with a third-party vendor.

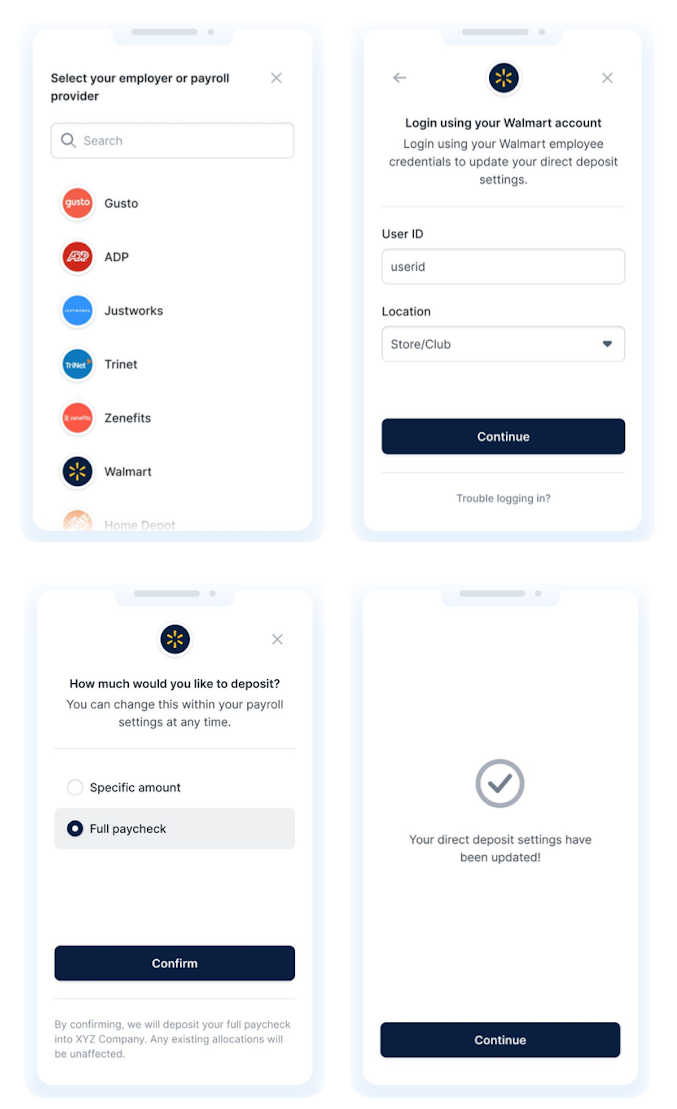

Customer experience

Your customers' experience can be as simple as this:

- Create an account on your platform.

- Launch a Direct Deposit Setup control on your interface.

Customers follow a simple set of prompts to set up direct deposit.

- Select the employer or payroll provider from a list.

- Log in using company credentials.

- Specify how much of each check—some or all—to deposit in the new account.

- Submit request.

- Get immediate feedback about the status of the request.

Because Direct Deposit Switch permits your customers to specify how much of a check to deposit in their accounts, they can create accounts for specific purposes, such as a vacation or education fund, and make regular deposits into those accounts.

Implementation

You need only create a user interface to launch the Direct Deposit Switch functionality. The interface is provided by Atomic:

- Employer/payroll selector

- Login screen

- Amount selector

- Success/failure screens

See Setting Up Direct Deposit Switch for implementation instructions.

Updated 12 months ago