Round Up

The Round Up feature is a way to accumulate funds based on card purchases. For example, if a purchase amount is 20.52, when that transaction settles, Galileo rounds up the amount to the next whole number and moves the difference into another account. In this case, it moves 0.48 into another account.

In this way, cardholders can build up savings accounts, contribute to a centralized charitable fund, move funds into other card accounts, or move funds into multiple other types of accounts.

Use cases

These use cases describe a few ways to use the Round Up function. You can devise other methods for your cardholders to leverage Round Up.

- Use case 1: Build up a savings account

- Use case 2: Contribute to a central fund

- Use case 3: Build up multiple accounts

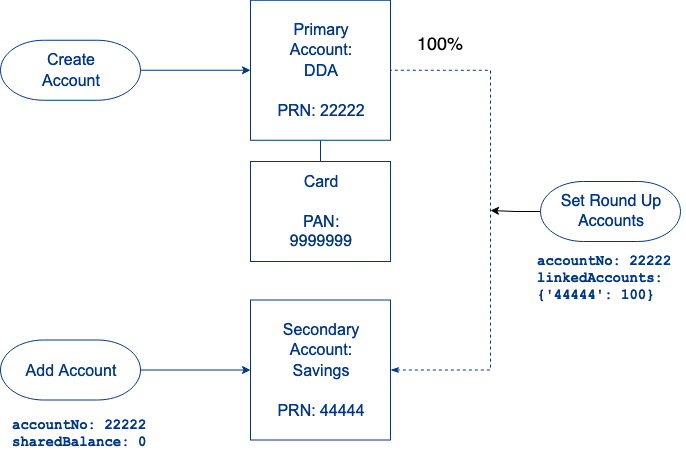

Use case 1: Build up a savings account

The cardholder wants to move the Round Up funds into her savings account.

- Create the card account with Create Account. The PRN is 22222.

- Create the savings account with Add Account. The PRN is 44444.

- Set up the Round Up relationship with Set Round Up Accounts, using these values:

accountNo: 22222linkedAccounts: {'44444': 100}

Note

If you are using Galileo's legacy implementation of Round Up, you can move Round Up funds only from a primary account to a linked secondary account, and there can be only one secondary savings account per primary account. The secondary account must have a product ID that has been set up for Round Up, and the accounts cannot share a balance. For the newer implementation of Round Up, any two accounts with any two product IDs can be linked for Round Up; however, they still cannot share a balance.

Alternate setups

- The cardholder can distribute funds between one secondary savings account and another account such as a DDA, as long as the accounts all have a different balance IDs. For example, if the cardholder has one secondary savings account, and two additional DDAs, the accounts can each receive 33% of the Round Up amount, or the amount can be distributed as 20%, 30%, 50%.

- The cardholder can set a threshold amount so that only Round Up amounts equal to or lower than the threshold will be transferred.

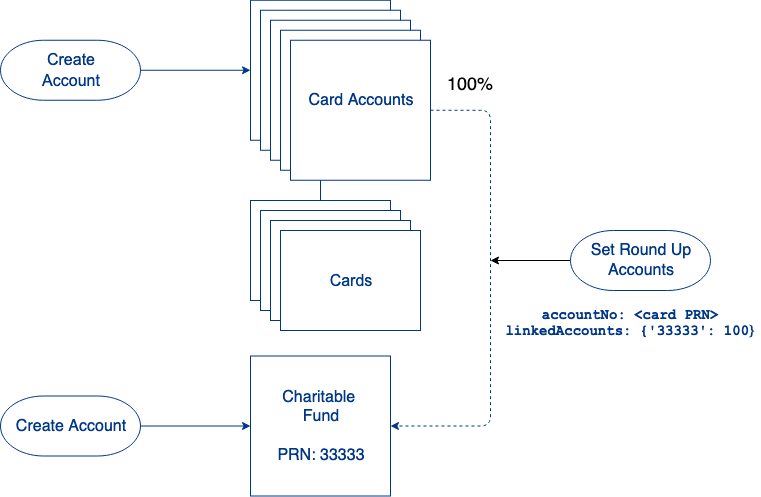

Use case 2: Contribute to a central fund

A business distributes spending cards to its employees, and the Round Up funds go into a central account that is used for charitable donations. The business has placed a limit of 0.75 on the Round Up transfers; if the amount is higher, then the settlement amount is not rounded up, and no funds are moved.

- Galileo sets the RFGTA parameter to

75. - Create the central account with Create Account. The PRN is: 33333

- Create the spending accounts using Create Account.

- For each spending account, use Set Round Up Accounts to set up the relationship:

accountNo:<spending PRN>linkedAccounts: {'33333': 100}

Alternative setups

- The business can create multiple charitable accounts, and each employee can determine how to distribute the funds across the accounts.

- The business can remove the threshold level, so any Round Up amount is valid.

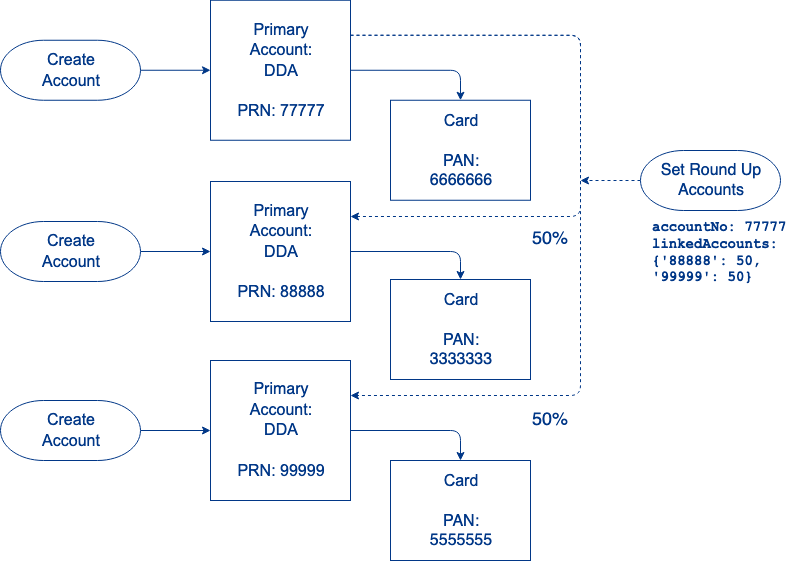

Use case 3: Build up multiple accounts

A cardholder wants to divide Round Up funds evenly between two card accounts that belong to his children.

- Create the parent's card account with Create Account. The PRN is 77777.

- Create each child's card account with Create Account. These accounts can be standalone primary accounts or secondaries to the parent's account, as long as they do not share a balance. The PRNs are 88888 and 99999.

- Use Set Round Up Accounts to divide the Round Up amount.

accountNo: 77777linkedAccounts: {'88888': 50, '99999': 50}

Alternative setups

- Instead of moving the Round Up funds into card accounts, a parent can create savings accounts for each child and move the funds there.

- A parent could also divide up the Round Up distributions between the card and savings accounts, either evenly or using different proportions.

Round Up transaction sequence of events

This scenario explains how Use Case 2 would play out when three cardholders make purchases.

- Cardholder 1 makes a purchase of 34.57. Galileo places a 34.57 hold on the account and sends the

BAUT: authevent message. - Cardholder 2 makes a purchase of 78.01. Galileo places a 78.01 hold on the account and sends

BAUT: auth. - Cardholder 3 makes a purchase of 21.79. Galileo places a 21.79 hold on the account and sends

BAUT: auth. - Two days later, the network sends a settlement batch file that contains all three transactions.

- Galileo settles the first transaction for 34.57 and moves 0.43 into the central fund. Galileo sends the

SETL: setlandBADJ: adjmessages for the cardholder account andBADJ: adjfor the central fund. - Galileo settles the second transaction for 78.01 and sends the

SETL: setlevent message for the cardholder account. The amount is not rounded up because 0.99 is higher than the threshold amount of 0.75. - Galileo settles the third transaction for 21.79 and moves 0.21 into the central fund. Galileo sends the

SETL: setlandBADJ: adjmessages for the cardholder account and theBADJ: adjmessage for the central fund. - A total of 0.84 has been deposited into the central account.

Note

If you are using the legacy Round Up implementation, the funds moving into the savings account trigger the

BPMT: pmtevent message instead ofBADJ: adj.

Insufficient Round Up funds

Because the Round Up amount is not part of the authorization hold, it is possible that when the transaction settles, there are insufficient funds for the Round Up transfer. In that case, Galileo does not transfer any funds. Round Up transfers cannot drive an account negative.

Viewing Round Up transactions

Both the Round Up funds moving out of the card account and into the Round Up account are adjustments (act_type: AD). The default otypes (transaction types) are:

rg— Adjustment into the Round Up accountRG— Adjustment out of the card account

You can arrange with Galileo to specify different otypes for your Round Up transfers by setting product parameters.

Tracking Round Up transactions

The BADJ: adj event messages do not contain the auth_id or setl_dtl_id for the transaction that triggered the Round Up transfer. However, the source_id for both BADJ: adj messages will contain the same value.

You might be able to infer which transaction triggered the Round Up transfer by correlating the SETL: setl timestamp with the amount in cents of the potential Round Up transfer. For example, if a BADJ: adj message for the Round Up account is for 0.37, and a SETL: setl near the same time is for 84.63, it is likely that the transfer corresponds to that transaction.

Enabling Round Up transactions

The legacy method of enabling individual accounts for Round Up is to call Set Account Feature with featureType: 11 and featureValue: Y. For the newer method, this step is not necessary.

Closing Round Up accounts

- If you are using the legacy Round Up method, call Set Account Feature on the DDA with

featureType: 11andfeatureValue: N. - For the newer method, follow the steps below.

Unlink the sole Round Up account

Keep the DDA active but remove the Round Up account linkage. This will disable the Round Up feature for the DDA.

- Call Get Roundup Accounts with the DDA for

accountNo. - The endpoint returns one

account_noand oneroundup_percentage. - Call Set Roundup Accounts with these values:

accountNo:PRN of the DDAlinkedAccounts: {"roundup_account_prn":100}expire: Y

Results

- The Round Up account is unlinked but not closed.

- If you want to relink the Round Up account later, pass the same values as above but set

expire: Nor leaveexpireblank. - If you want to close the Round Up account, use Modify Status with

type: 2.

Unlink one Round Up account of two

There are two Round Up accounts linked to the same DDA—PRN1 and PRN2—and you want to unlink PRN1. The DDA will remain active, and all Round Up funds will be moved into PRN2.

- Call Get Roundup Accounts with the DDA for

accountNo. - The endpoint returns two entries:

"roundup_accounts": [

{

"account_no": "PRN1",

"roundup_percentage": 45

},

{

"account_no": "PRN2",

"roundup_percentage": 55

}.

- Call Set Roundup Accounts with these values. The percentage for PRN2 must be changed to 100, which will automatically set the other account to 0%.

accountNo:PRN of the DDAlinkedAccounts: {"PRN2":100}

Results

- All Round Up activity will now go to PRN2.

- You can relink PRN1 later (taking care to set the right percentage).

- If you want to close the PRN1, use Modify Status with

type: 2.

Close the DDA

If you need to close a DDA that has Round Up accounts linked to it, and you want to close all of the accounts including the Round Up accounts, just close the DDA using the account-closure method that is appropriate to your circumstance.

Results

- The DDA and the Round Up accounts are all closed.

Galileo setup

Galileo will configure these product parameters according to your use case. Refer to the Round Up table on the Parameters page for additional details on these parameters. (This current Round Up version is sometimes called "Round Up for Good.")

| Parameter | Description |

|---|---|

| RFGDA | Contains a custom adjustment type (AD) for funds moving into the Round Up deposit account. When this parameter is not set, the value is rg. |

| RFGUA | Contains a custom adjustment (AD) type for funds moving out of the card account. When this parameter is not set, the value is RG. |

| RFGTA | Specifies a Round Up threshold value. If the amount to round up is greater than the value in this parameter, then no round up occurs. When this parameter is not set, there is no threshold limit for Round Up. Valid values are integers 1–99. |

Legacy Round Up

If you are using Galileo's legacy version of Round Up (also called "Round Up for Savings"), you will already have these parameters configured.

Note

Do not set these parameters on new setups.

| Parameter | Description |

|---|---|

| RUADT | Contains a custom adjustment type (AD) for funds moving out of the card account. When this parameter is not set, the value is ru. |

| RUXRT | Contains a custom payment type (PM) for funds moving into the savings account. When this parameter is not set, the value is RU. |

| RFGTV | Specifies a Round Up threshold value. If the amount to round up is greater than the value in this parameter, then no round up occurs. When this parameter is not set, there is no threshold limit for Round Up. Valid values are integers 1–99. Default: 99. |

Updated about 1 year ago