Setting Up Direct Deposit Switch

This guide explains how to set up Direct Deposit Switch using the Get Direct Deposit Switch Token endpoint. Before performing this procedure, you may want to read the Direct Deposit Switch guide for general information on the user experience and use cases.

Result of following this procedure

Cardholders can use your interface to set up direct deposit into an account they hold with you.

Setup

You must integrate with the third-party direct deposit switch (DDS) provider through its SDK. Obtain the documentation from the DDS provider at this link. Galileo must also perform setup steps on the back end.

Workflow

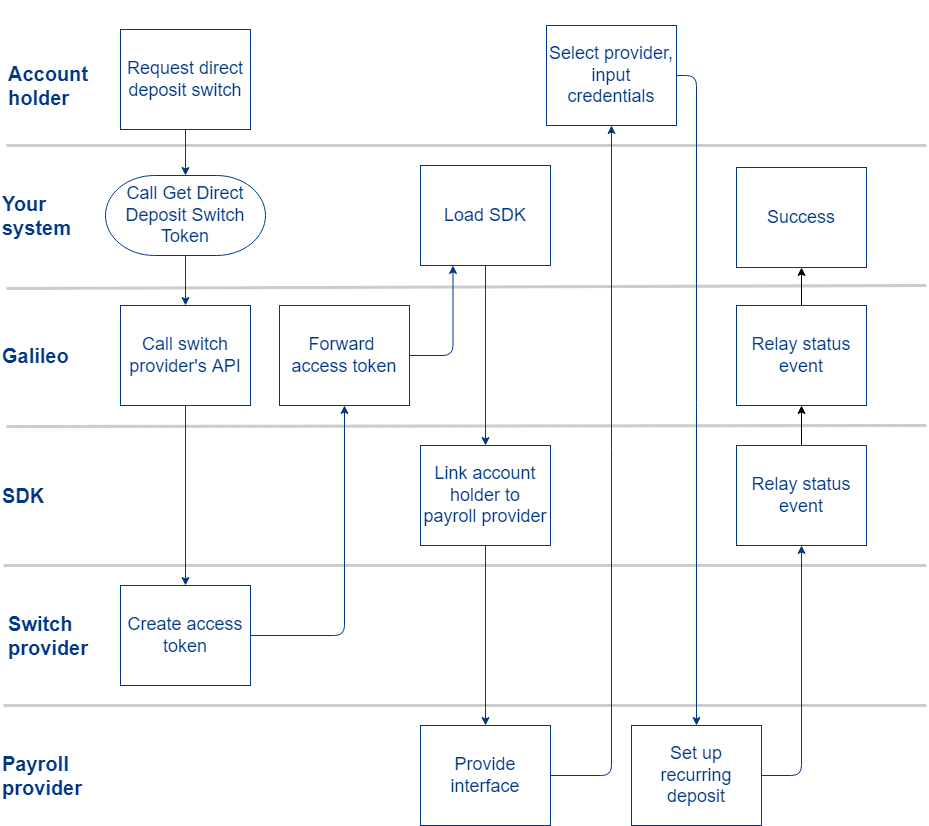

These are the entities involved in DDS:

- Account holder — Your customer, who has at least one account on your platform

- Your system — Your mobile app or web page, which has a control to launch the DDS process.

- Galileo — The Galileo system

- SDK — Interfaces with the switch provider

- Switch provider — Interfaces with the deposit provider

- Payroll provider — Paycheck distributor such as ADP, an employer, or a government benefits distributor

Direct Deposit Switch workflow

- Your customer creates a new account on your platform, or the account holder already has an account on your platform.

- The account holder activates an "add direct deposit" control on your interface.

- You call the Get Direct Deposit Switch Token endpoint and pass the routing and account numbers of the account that will receive the deposit.

- Galileo forwards the token request to the switch provider, which generates the token.

- Galileo forwards the token to you in the endpoint response.

- The SDK calls the payroll provider's interface and passes the account holder's account and routing numbers.

- The payroll provider returns its interface, which you present to the account holder.

- The account holder selects the deposit provider from the interface and inputs their login credentials.

- Galileo sends the

DDSE: direct_deposit_switch_eventevent message to you withstatus: processing. - The payroll provider sets up a recurring deposit (ACH credit) with the routing and account numbers previously supplied.

- The DDS provider returns a webhook message to Galileo that reports success.

- Galileo sends the

DDSE: direct_deposit_switch_eventevent message to you withstatus: completed.

When the payroll provider sends the deposit, it arrives at Galileo as an ACH credit in a Nacha file. When the deposit is posted to the customer account, Galileo sends a BPMT: pmt event message. The otype is a code that Galileo sets up for you to indicate direct deposits.

Example scenarios

These scenarios explain how to implement Direct Deposit Switch for checking and savings accounts.

Scenario 1: Deposit into a checking account

- Issuer name — CardOfMine. Routing number 33333

- Customer name — Adela Sanchez

- Adela Sanchez opens a DDA with CardOfMine. The PRN is 77777.

- Adela clicks the "direct deposit" control on CardOfMine's interface. Adela indicates that she wants the direct deposit to go into this new DDA.

- The interface asks her to provide a description for the deposit. She inputs

My Job Paycheck. - CardOfMine's interface calls Get Direct Deposit Switch Token with these values:

| Parameter | Value |

|---|---|

accountNo | 77777 |

ddSwitchAccountNo | 77777 |

ddSwitchRoutingNo | 33333 |

ddSwitchAccountType | checking |

ddSwitchAccountDescription | My Job Paycheck |

- Galileo passes the values to the DDS provider in a token request.

- The DDS provider returns the token and Galileo forwards it to CardOfMine's interface.

- CardOfMine's interface loads the SDK, passes the token, and retrieves the direct deposit interface.

- Adela selects her paycheck provider and logs in using her company credentials.

- Adela specifies that 50% of her paycheck should go to her CardOfMine account.

- The paycheck provider creates a recurring ACH credit transaction using the account number 77777 and routing number 33333. The transaction parameters also include the fact that the CardOfMine account is a checking account.

- After one or two pay cycles, Adela's paycheck provider sends half of her paycheck to her CardOfMine account.

- Later, Galileo receives the deposit in a Nacha file

- Galileo posts the deposit (payment) to Adela's account.

Scenario 2: Deposit into a savings account

- Issuer name — IssueMyCard. Routing number 44444

- Customer name — Karl Schwartz

- Karl signs up for a checking account and accompanying savings account with IssueMyCard.

- IssueMyCard creates the checking account as a primary account (PRN: 22222) and creates the savings account as a secondary account (PRN: 88888) to the checking account.

- Karl clicks the "direct deposit" control on IssueMyCard's interface. Karl indicates that he wants all of the direct deposit to go into his new savings account.

- The interface asks him to provide a description for the deposit. He inputs

Deposit to Savings. - IssueMyCard's interface calls Get Direct Deposit Switch Token with these values:

| Parameter | Value |

|---|---|

accountNo | 22222 |

ddSwitchAccountNo | 88888 |

ddSwitchRoutingNo | 44444 |

ddSwitchAccountType | savings |

ddSwitchAccountDescription | Deposit to Savings |

- Galileo passes the values to the DDS provider in a token request.

- The DDS provider returns the token and Galileo forwards it to IssueMyCard's interface.

- IssueMyCard's interface loads the SDK, passes the token, and retrieves the direct deposit interface.

- Karl selects his paycheck provider and logs in using his company credentials.

- Karl specifies that all of his paycheck should go to his IssueMyCard savings account.

- The paycheck provider creates a recurring ACH credit transaction using the account number 88888 and routing number 44444. The transaction parameters also include the fact that the IssueMyCard account is a savings account.

- One or two pay cycles later, Karl's paycheck provider sends all of his paycheck to his savings account.

- Later, Galileo receives the deposit in a Nacha file

- Galileo posts the deposit (payment) to Karl's account.

Events API

During the direct deposit switch process, Galileo sends the DDSE: direct_deposit_switch_event Account Event when the status of the deposit setup changes. This event is first triggered when Galileo generates a token and sends it to you in the endpoint response. Subsequent status changes also trigger this event message.

The possible values for status and old_status are:

processing— The direct deposit transactions are being set up.completed— The direct deposit switch has been successfully set up.failed— The direct deposit switch process failed.

When status: failed, the status_reason field is populated by one of the values in the Direct Deposit Switch Failure Status Reasons enumeration.

Viewing Direct Deposit Switches

Request the Direct Deposit Switch CDF, which contains all of the direct deposit switch transactions from the previous day.

Updated over 1 year ago