About Disputes

This guide explains the general dispute process. See Disputes at Galileo for Galileo's dispute process.

Account holders have the right to dispute a charge when they question the legitimacy of a transaction that was posted to their account. This guide explains two types of transactions that might be disputed: card transactions and ACH transactions. Each type of dispute passes through different processes depending on the type of program (such as consumer or business).

- ACH transactions — See ACH disputes for more information.

- Card transactions — Continue reading.

Card transaction disputes

In the United States, the primary regulations that govern consumer card-transaction disputes are:

- Regulation E (Reg E) — The Electronic Funds Transfer Act, which applies to debit accounts

- Regulation Z (Reg Z) — The Truth in Lending Act, which applies to credit accounts

For commercial card-transaction disputes, generally those are not covered by any specific regulation, but may be depending on a number of factors. Galileo can work with you and/or your sponsor bank to determine applicability.

For disputes in other countries, ask Galileo where you can find the applicable regulations.

Card-transaction dispute lifecycle

A card-transaction dispute passes through various stages before completion. A dispute can potentially pass through all of these steps:

- Transaction posted

- Dispute initiated

- Chargeback

- Second presentment

- Arbitration

1. Transaction posted

As explained in About Card Transactions, merchants "clear" each card transaction by periodically submitting a list of charges to their acquiring banks. These charges are accompanied by receipts and other evidence that proves the legitimacy of the charges. This clearing process is also called the "first presentment," because it is the first time that the merchant submits evidence of a transaction's legitimacy.

After the acquiring banks submit the charges to the networks, the networks send the charges to the issuer, who is obligated to post all charges to cardholder accounts. After transactions have been thus settled, they can be formally disputed, when the issuer or the cardholder disagrees with a charge. Sometimes arrangements can be made to permit disputes on unsettled (pending) transactions, but only settled transactions can be formally disputed.

2. Dispute initiated

A card-transaction dispute may be initiated by one of two parties:

- Issuer — An issuer may dispute a charge that it suspects is illegitimate or incorrect and that has caused financial harm to the issuer, such as a force-posted transaction that was not first authorized or a settlement that is far in excess of the authorized amount, thus causing a negative balance on a debit account.

- Cardholder — Cardholders are entitled to contact their card's issuer to dispute a charge that has been posted to their account. Legitimate reasons for disputing a transaction are suspected fraud or merchant error and include:

- Duplicate transactions

- Unauthorized transactions

- Charged more than was agreed to

- Item or service not provided

- Item or service not satisfactory

- Credits not posted to account

- Canceled recurring transactions

- Returned merchandise (buyer's remorse)

- Defective merchandise/not as described

Note

Some cardholders abuse the dispute system for outright fraudulent reasons, and others initiate a dispute for legal but inappropriate reasons. See Cardholder fraud and Friendly fraud for more information.

Issuers must provide cardholders with at least one way to initiate disputes, such as:

- Customer-service phone number

- Online chat

- "Dispute transaction" control in app or website

- Mailing address

- Fax number

Cardholders are permitted to initiate a dispute up to 60 days after the statement receipt date. For mailed (paper) statements, receipt date will be later than the statement posted date. For example, if the statement posted date is May 1 but the statement is received on May 5, the 60 calendar days start from May 5. For electronic statements, the 60 days start on the date the statement is made available for the cardholder to view. For example, if the statement cycle ends on May 1, the 60 calendar days start on May 1. After the deadline, an issuer will still perform a thorough investigation, but the dispute would not have Reg E protections. In the United States, the Reg E timeframe can be extended for various reasons, including extenuating circumstances such as natural disasters or family emergencies.

Under Reg Z, issuers must acknowledge the receipt of a credit dispute within 30 days of receiving the dispute from the cardholder.

The issuer performs a preliminary evaluation of the case and then takes one of these steps:

- If the issuer determines that the dispute is not valid based on the evidence, it will reject the dispute and send the cardholder the appropriate communication. For example, if a transaction was authenticated with 3-D Secure, the issuer or cardholder cannot dispute the transaction as fraudulent.

- If no chargeback rights exist under the card network rules, and the dispute is valid, the amount is written off (the issuer grants the dispute amount to the cardholder at a loss to the program) and the cardholder is notified of the outcome.

- If the dispute is either determined to be valid or the issuer needs additional information, and there are chargeback rights per the card network rules, the issuer may use the chargeback process as a part of its investigation.

Provisional credit

If the issuer decides to continue investigating the dispute, the debit cardholder may be entitled to provisional credit, which means that the issuer temporarily awards the disputed amount to the cardholder while the dispute is being processed. Reg E (consumer debit accounts) specifies that if the disputed transaction is a merchant error, the issuer has 10 days to investigate the dispute (20 days for a new account), and if the issuer is unable to resolve the case in that time, the cardholder should be awarded provisional credit. After the provisional credit is awarded, the deadline for resolving the dispute is extended to 45 days (ATM only); 90 days for foreign and POS or a new account.

For disputes that involve non-receipt of merchandise, items not as described, canceled services, credit not processed, and quality of service, Reg E does not apply. For credit accounts, Reg Z indicates that the cardholder is not obligated to pay the disputed amount (including any interest) while it is under investigation.

Generally, provisional credit is not issued on commercial debit accounts.

3. Chargeback

If the issuer is unable to determine whether the dispute is valid and needs more information from the merchant, it can raise a chargeback. Issuers use the chargeback process to gather additional information for their investigations as well as recover the disputed funds. For this reason the card networks have strict rules about who, when and what information must be included to raise a chargeback. Failure to include all required information could result in the dispute being dismissed or settled in the merchant's favor. For this reason, issuers should have a thorough intake process that ensures that all information is in order before raising a chargeback.

When the chargeback is raised, the network provisionally moves funds into the issuer's “suspense” account (not the cardholder's) and out of the merchant's account. The chargeback notifies the merchant that there is an issue with the first presentment and requests additional information from the merchant to corroborate the charge.

4. Second presentment

When the issuer raises a chargeback, it provides the merchant with the details of the disputed transaction and requests further evidence of the transaction's legitimacy.

The merchant has three options:

- Refund the cardholder — The merchant may participate in a “pre-chargeback” service called "collaboration" that allows the merchant to determine that a dispute is valid, such as a duplicate transaction or an improperly fulfilled order, prior to a chargeback being raised via the normal process. The merchant can submit a merchant credit via these services, and the chargeback is considered settled.

- Accept the chargeback — The merchant may determine that the dispute is valid and accept the chargeback either by sending a notification that they accept the chargeback or by not responding to the chargeback by the allowed response period (30 days for Visa and 45 days for Mastercard). Once the response period expires, the chargeback is considered settled and if applicable, the cardholder keeps any provisional credit that was awarded.

- Challenge the dispute — If the merchant believes the dispute is in error, the merchant makes a "second presentment" (or "representment") of evidence to support the transaction. With this challenge, the network reverses the chargeback funds into the merchant's account and out of the issuer's suspense account. The merchant must provide compelling evidence to remedy the chargeback which may include one or a combination of these items, among others:

- A positive AVS response

- Sales receipts

- Proof of shipping (shipping receipt, tracking number)

- Proof of delivery (photo of delivered item, delivery receipt, confirmation email)

- Proof that the ship-to address was accurate

- Any correspondence with the customer

- IP addresses for online purchases

- Terms and conditions that the account holder agreed to

The merchant sends the second presentment to the issuer, who re-evaluates the dispute. If the issuer finds the merchant's response to disprove the cardholder's claims, then the issuer determines that no error occurred and withdraws provisional credit, if applicable, from the cardholder. The dispute is then closed.

On the other hand, if the issuer believes the second presentment does not sufficiently refute the cardholder's claims, the issuer can raise a second chargeback, and the dispute goes into pre-arbitration. During pre-arbitration the merchant has three options:

- Accept liability for the chargeback — The cardholder is refunded in full.

- Provide additional evidence — Help the issuer determine that the chargeback is not valid.

- Request arbitration — Ask for the network to make the decision.

5. Arbitration

Arbitration is the final step in the chargeback process and it is important that there be a strong case, because the card network charges a substantial fee for this process. During arbitration, the card network steps in to determine whether the dispute is valid. Once the network has provided a verdict, the decision is final, and there can be no further challenges. Depending on how the verdict is rendered, funds may be moved back into the account of the winning party and the losing party pays the fee to the network.

Receiving the verdict

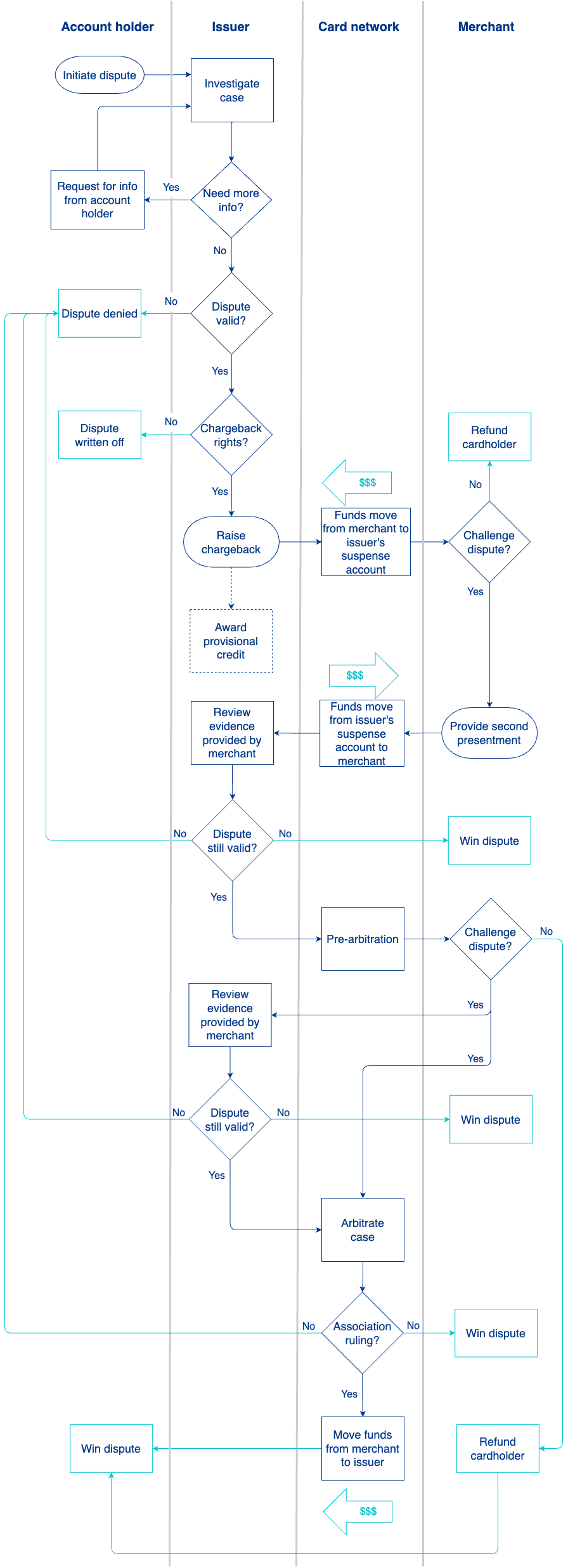

When a decision is made about the dispute, the entity that performed the evaluation (usually the issuing bank) returns a verdict either in favor of or against the account holder. As shown in the flowchart below, the dispute can be resolved at various points during the dispute process—shortly after initial submission, after the merchant receives the dispute, after the second presentment, or after arbitration.

When the dispute is resolved, the issuer must officially notify the cardholder, either electronically or by paper letter, according to the applicable regulations.

Disputes flowchart

This flowchart shows how each participant functions in the dispute process in Steps 2–5, as well as showing how the funds move. The aqua boxes show the various points at which the dispute can be resolved in either the cardholder's favor or the merchant's.

Cardholder fraud

Fraud on a card account can fall into one of these categories:

- Fraudulent card or account — A malicious user obtains a card by theft (either the physical card or the card number through computer hacking or interception) or prints a counterfeit card.

- Happens at the point of sale

- Liability typically falls on card issuer

- Deterrence through strong card authentication

- Chargeback fraud — Cardholders dispute transactions with the intent of defrauding the merchant and/or issuer, such as claiming that the purchase was unauthorized, they did not receive an item, or claiming damage but not returning the damaged merchandise.

- Happens after settlement

- Liability typically falls on merchant

- Deterrence through record-keeping, contesting disputes

- Some motives for chargeback fraud include:

- Buyer's remorse

- Finding the merchant's return process to be too difficult

- Not knowing that disputes are not the same as the return process

- Misunderstanding the delivery schedule

- Wanting to return an item without paying a restocking fee

- Asking for a return after the return deadline has passed

Cardholders suspected of chargeback abuse are often blacklisted by merchants. In some cases, merchants can take chargeback abusers to court, and some jurisdictions will prosecute them as criminals.

"Friendly fraud"

Most disputes are filed not for fraud or merchant error but for inappropriate reasons in what is known as "friendly fraud." It's called "friendly" because the cardholder does not necessarily intend to defraud the merchant but instead does not understand some aspect of the transaction or how disputes are supposed to work.

Some of the most common reasons for inappropriate chargebacks include:

- An unrecognized purchase made by a family member

- Not recognizing the merchant description on the transaction, because it is different from the merchant name

- Cardholder thought they had stopped a recurring transaction

Chargeback fraud and issuers

This is the typical breakdown of chargebacks:

- 5–15% — True chargeback fraud

- 10–15% — Merchant error

- 60–76% — Friendly fraud

Source: Chargeback Fraud 101, PaymentsJournal, 3 Feb 2022

Although merchants bear the greater burden for chargeback fraud, the issuer can also be negatively affected. There is a positive correlation between high numbers of chargebacks and authorization denials. High numbers of chargebacks affect fraud-detection systems that use machine learning to detect patterns. The more chargebacks are raised against a merchant, the more "suspicious" the merchant looks to the fraud-detection system, which results in more authorization requests being denied. When a transaction is denied, a cardholder is likely to use a different card for the payment, and the denied card ends up at the "back of the wallet," where it will be used less frequently or not at all.

Most dispute-intake systems screen for some types of friendly fraud, such as asking the cardholder if an unrecognized transaction could have been performed by another authorized card user or family member, or asking for evidence that the cardholder already attempted to resolve the issue with the merchant.

To help prevent chargeback fraud, both the friendly and malicious types, issuers should monitor accounts that have a high number of disputes, especially those that are resolved in the merchant's favor. If the cardholder appears to be abusing disputes, the issuer can impose penalties such as freezing the card, assessing fees, or terminating the account.

ACH disputes

Some merchants prefer using the ACH system for funds transfers because of lower processing costs. Many peer-to-peer cash transfer apps use ACH, for example, and utilities companies also rely on ACH. When an ACH transaction is disputed it constitutes an ACH Return. Both Regulation E and Nacha rules govern ACH disputes.

- The allowable reasons for returning ACH transactions are far narrower than for card transactions. Dissatisfaction with merchandise or services is not a valid reason.

- Account holders can ask for an ACH return only under these circumstances:

- An entity, such as a utility company, posted duplicate debits.

- The entity that posted the debit is not authorized to withdraw funds.

- The account was debited before the date authorized.

- The amount debited was different from the amount that was authorized.

- The account holder revoked authorization prior to the funds being debited.

- Account holders can have 60 days to dispute a transaction, depending on the ACH type.

- Merchants cannot contest ACH disputes. For this reason, banks subject ACH disputes to far more scrutiny than card disputes. Account holders must fill out a Written Statement of Unauthorized Debit (WSUD), and they can be subject to penalties that can result from making false claims of unauthorized debits. These penalties include fines of up to $1,000,000, imprisonment of up to 30 years, or both.

- The ACH dispute is evaluated only by the banks. There is no intermediary to arbitrate claims.

ACH dispute return codes

These are return codes that are provided in the Nacha file when there is a dispute. Except as noted, each of these return codes requires a WSUD from the account holder, and each return must be submitted within 60 calendar days of the transaction being posted to the recipient account.

| Code | Description | Explanation |

|---|---|---|

| R05 | Unauthorized debit | The debit was not authorized by the receiver (account holder). |

| R07 | Authorization revoked by customer | The account holder previously authorized the originator to withdraw funds but has revoked authorization from the originator. |

| R10 | Customer advises unauthorized transaction | The account holder has no previous relationship with the originator and has never authorized the originator to debit the account. |

| R11 | Customer advises entry not in accordance with the terms of the authorization | The transaction is inaccurate or improperly initiated, the source document was ineligible, notice was not provided to the account holder, or the amount was inaccurately obtained. |

| R29 | Corporate customer advises not authorized | The receiver has notified the sending entity that the corporate debit entry, transmitted to a corporate account, is not authorized. This return code must be submitted within two banking days but a WSUD is not required. |

ACH dispute–related transaction otypes depend on your bank and on your program setup. Consult your Funds Flow document from Galileo Finance, which includes ACH dispute–related otypes.

Externally initiated ACH disputes

An RDFI can return an ACH transaction that one of your customers originated when the recipient account holder challenges the transaction. Nacha requires that as an originator you keep disputes below 0.5% of ACH debit returns for the preceding 60 days.

To help prevent these ACH disputes, ensure that your onboarding processes include anti-money laundering measures that screen for account holders who are likely to abuse the ACH system.

For more information on the ACH return process, consult these guides:

- Incoming ACH returns workflow in the Galileo ACH Workflows guide

- ACH returns and stop-payment orders in the ACH at Galileo guide

Galileo setup

See the Disputes parameters table for details of the full list of product parameters to be configured at Galileo.

Updated about 1 year ago