Overdraft Workflows

Authorization with overdraft

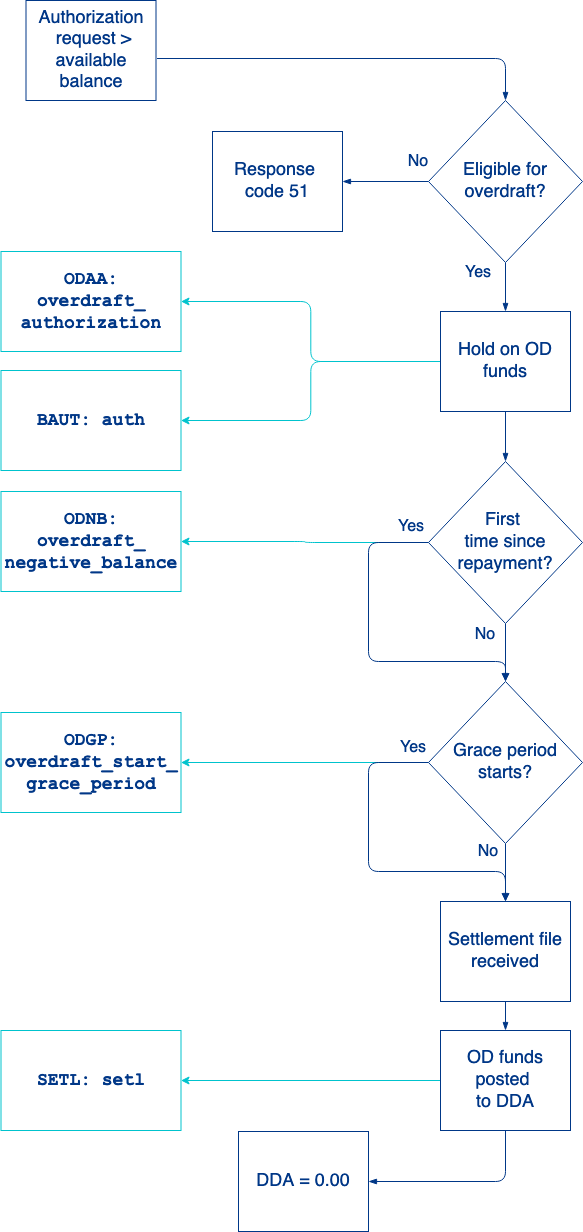

This flowchart illustrates authorization and settlement for a card transaction that uses overdraft funds.

- An account holder makes a purchase over card network rails and the card network sends an authorization request. The DDA has insufficient funds to cover the purchase, but the account is linked to an overdraft account.

- Galileo determines whether the authorization request is eligible to draw from the overdraft account. Eligibility depends on whether the transaction is a qualifying purchase and if there are sufficient funds available in the overdraft account line of credit.

- Not eligible — Galileo denies the authorization request and sends response code

51to the card network. - Eligible — Galileo places a hold for the authorized amount on the overdraft account.

- Galileo sends the

BAUT: authevent and theODAA: overdraft_authorizationevent. - If this is the first time the DDA has drawn on the overdraft account since the overdraft account was fully repaid, Galileo sends the

ODNB: overdraft_negative_balanceevent. - If the authorization exceeds de minimis and triggers a grace period for fee repayment, Galileo sends the

ODGP: overdraft_start_grace_periodevent.

- Galileo sends the

- Not eligible — Galileo denies the authorization request and sends response code

- The card network sends a settlement batch file.

- Galileo backs out the authorization hold on the primary account and posts the overdraft funds to the primary account, bringing the DDA balance to 0.00.

- Galileo sends the

SETL: setlevent.

Overdraft fees

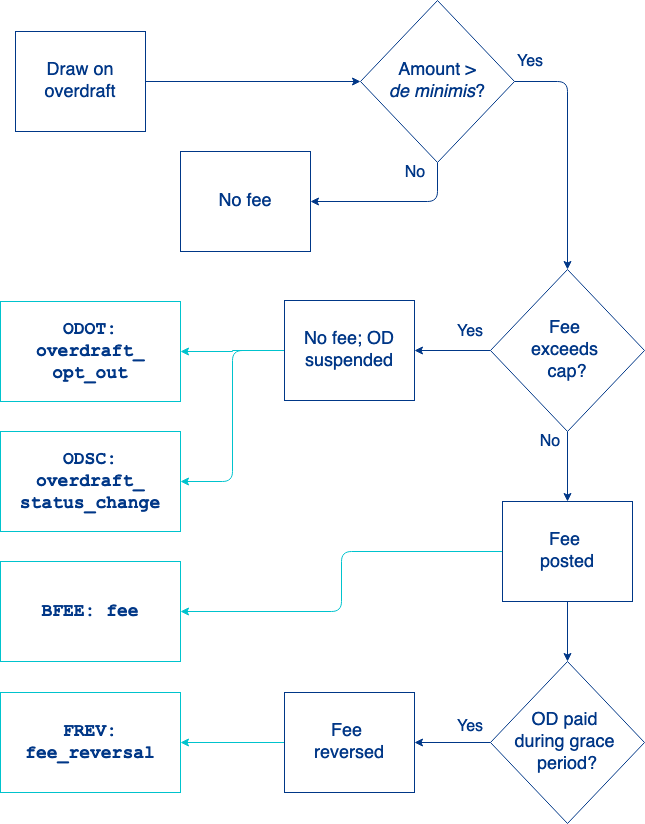

An overdraft fee is usually charged when a primary account draws from its overdraft account, with some exceptions. This flowchart illustrates the process to determine when overdraft fees are charged to an account.

- An account holder makes a purchase with insufficient funds in the primary account. The DDA draws on its overdraft account.

- Galileo determines if the amount owed to the overdraft account exceeds the de minimis threshold.

- Does not exceed — Galileo does not post an overdraft fee.

- Exceeds — Galileo determines whether the fee would exceed the fee cap:

- Does not exceed — Galileo posts the overdraft fee and sends the

BFEE: feeevent message. - Exceeds — Galileo does not post the overdraft fee but starts the process to suspend the overdraft account. Galileo sends the

ODOT: overdraft_opt_outand theODSC: overdraft_status_changeevent messages.

- Does not exceed — Galileo posts the overdraft fee and sends the

- If the overdraft amount is paid within the grace period, Galileo reverses the overdraft fee and sends the

FREV: fee_reversalevent message.

Note

Overdraft fees do not trigger repayment. The DDA balance will remain negative until the overdraft amount is paid.

Overdraft repayment

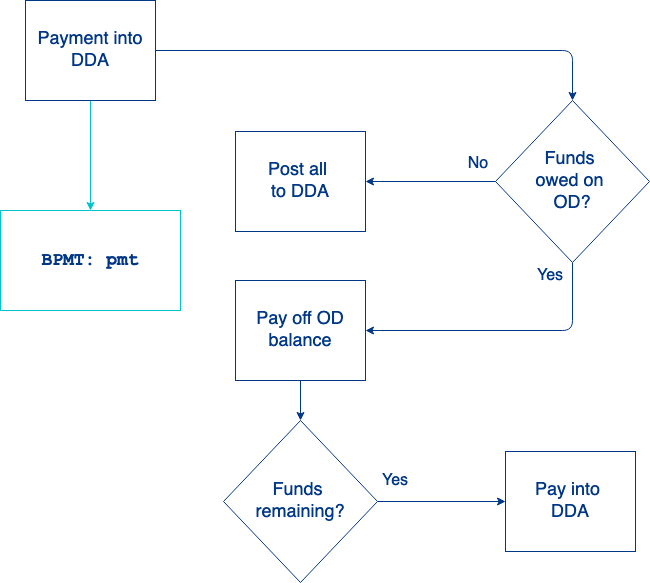

This flowchart illustrates the process to repay funds owed on an overdraft account.

- A payment is made to a DDA that is linked to an overdraft account. Galileo sends the

BPMT: pmtevent. - If funds are not owed on the overdraft account, the full payment is posted to the DDA balance after any fees are paid.

- If funds are owed on the overdraft account once settlement occurs:

a. The payment is first posted to the overdraft balance.

b. The remaining amount is posted to the DDA after any fees are paid.

Charge-off

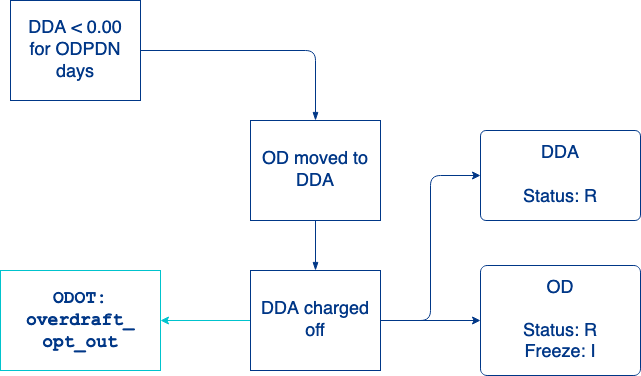

When an overdraft account remains unpaid for a specified period (usually 35 days), a process to transfer funds and charge-off the account is triggered. This flowchart illustrates a possible configuration for the charge-off process.

- An overdraft account remains unpaid for the number of days set by ODPDN (typically 35 days).

- The owed funds are moved out of the overdraft account and into the DDA. The total amount owed is now the negative primary account balance combined with the overdraft line of credit consumed (configured with ODPAA).

- The primary account and overdraft account are set to status:

R(charge-off) (configured with ODMOB). - Account feature

17(overdraft eligibility or participation) is set toI(ineligible). The account holder can no longer use the overdraft account (configured with ODOBI). - Galileo sends the

ODOT: overdraft_opt_outevent.

Updated about 1 month ago