Payment Screening for Incoming ACH Credits

Payment Screening is a service used to detect fraud by automatically inspecting incoming ACH credit transactions for receiver name mismatches. It verifies if the name associated with the transaction aligns with the name on the receiving account registered in the Galileo system. When names match, the transaction undergoes regular processing, followed by validations against controls such as amount thresholds and load limits. Mismatches can result in transactions being flagged for manual review. Using Payment Screening streamlines the review process, optimizing operational costs and ensuring smooth transaction processing. Additionally, Galileo offers the flexibility to handle flagged transactions either internally or via Galileo’s dedicated anti-fraud operations team.

Key capabilities

- Set up automated reviews for all incoming ACH credits or specifically for tax credits.

- Following manual reviews, you can post transactions as per the settlement date or force-post to sidestep load-limit reviews.

- Ensure appropriate return codes are applied to transactions.

- Flag a transaction for a second review after an initial inspection.

- Produce reports detailing transactions sent to manual review, inclusive of the actions executed.

Manual review process

Incoming ACH credits undergo an automatic name-check, flagging any transactions with name discrepancies for manual review. If a program activates this feature for all ACH credits, then every transaction—including tax credits—undergoes a name screening. When set for tax-specific credits, only federal tax and selected state tax credits are verified for name alignment.

Galileo offers two methods to perform manual review: using the CST or our Program API Get Pending Deposits and Modify Pending Deposits to perform manual review.

Via CST

Review queued transactions from the CST on the Payment Posts & Returns page. Reach out to Galileo for access to the guide.

Via Program API

When using the Program API, this workflow consists of three simple steps:

- Call the Get Pending Deposits endpoint to retrieve a list of incoming ACH credits pending manual review.

- Look for transactions with the

RNMcategory code (name mismatch). - Call the Modify Pending Deposits endpoint with the decision to approve or reject each

RNMtransaction.

Note

If you reject the transaction, use

retCode: R17to indicate that the entry was initiated under questionable circumstances. This return code is available only to programs with sponsor bank approval.

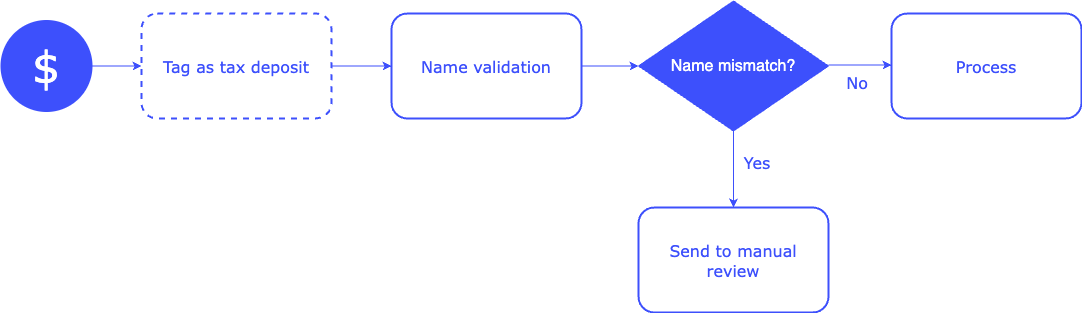

Example scenario: A questionable tax refund

This is an example of how it can be set up to help identify suspicious tax refunds, which uses source identification and name matching.

- Payment screening automatically identifies all incoming ACH credits, or incoming ACH tax credits only (source identification).

- The payment screening function proceeds to compare the name in the incoming ACH transaction to the name in Galileo's system (name-matching).

- If name-matching is a success, the transaction is processed as normal and validated against other controls, such as amount-threshold checks and load-limit checks (if set for the program).

- If name-matching fails, the transaction is sent to manual review, where it requires further action from the operations manager (either on your side or Galileo's). The category of the transaction is flagged as

RNM. See the workflow below for more details.

Refer to the Payment Screening for tax refunds simulation guide for step-by-step instructions for testing this feature in the CV environment.

Galileo setup

| Parameter | Level | Description |

|---|---|---|

| RNMCK | Program | Must be set to A to enable validation for all incoming ACH credits, or set to Y for incoming tax credits only. |

Updated 6 months ago